July 2021

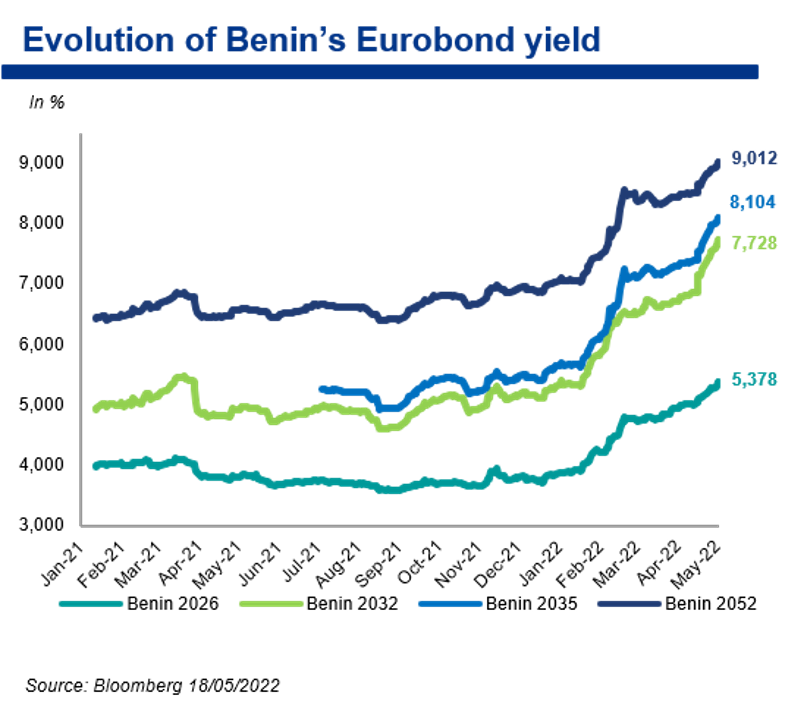

In July 2021, Benin issued a Eurobond of € 500 million (328 billion XOF with a 14-year final maturity). This was the first SDG Eurobond issuance by an African country and one of the first worldwide and exclusively financed various social and environmental projects contributing to achieve the SDGs. With this SDG Eurobond, Benin reaffirms its innovative and proactive debt management strategy and renews its commitment to the SDGs. The 4.95% coupon obtained for this issuance reflects investors’ confidence (with a subscription rate of 300%) in Benin’s creditworthiness. The negative new issue premium of 0.20 percentage points obtained demonstrates the significant interest of investors for this innovative instrument.

The success of the Eurobond SDG issuance was obtained through a well-defined strategy by the Government following the major steps:

- Preparation of an SDG bond issuance framework document (including Benin’s climate commitments and the SDG strategy);

- Agreement with Vigeo Eiris (Moody’s Group), a specialized institution, for conducting an independent assessment of Benin’s issuance project;

- Permanent Benin’s financial rating to reinforce the country’s creditworthiness and investors’ confidence;

- Setting up of a management, monitoring and reporting committee

Download